Utah concedes to Nevada water demands in draft agreement

Posted on | August 13, 2009 | 3 Comments

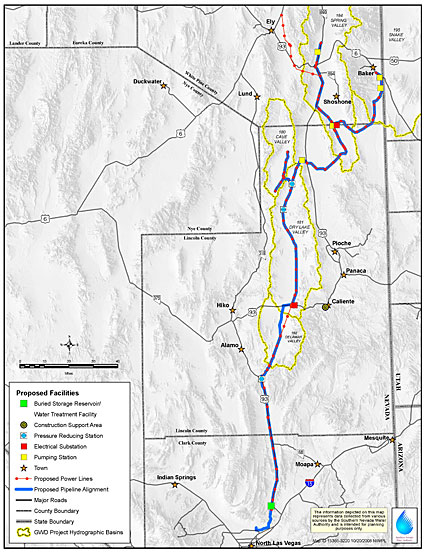

BREAKING NEWS: Utah and Nevada today produced a draft agreement for the splitting of groundwater from the shared basin of Snake Valley.

Since making the single largest block of groundwater claims in Nevadan history in 1989, Southern Nevada Water Authority general manager Patricia Mulroy has been seeking Snake Valley groundwater, along with reserves from four other target basins, to feed a 300-mile-long pipeline proposed to tap the Great Basin Carbonate Aquifer. Snake Valley is the second most water-rich valley in the Las Vegas pipeline plan.

Click here for more on the Utah concession to Las Vegas

Tags: chance of rain > Emily Green > Las Vegas > Patricia Mulroy > pipeline

Makeover city

Posted on | August 13, 2009 | No Comments

SOME acronyms exist merely to make us sound drunk. The city of Long Beach’s BLBL is one. But what the Beautiful Long Beach Landscapes program lacks in mellifluousness, it makes up for in success. BLBL is a key part of a drive that has cut Long Beach water use by 16.5% since fall 2007.

SOME acronyms exist merely to make us sound drunk. The city of Long Beach’s BLBL is one. But what the Beautiful Long Beach Landscapes program lacks in mellifluousness, it makes up for in success. BLBL is a key part of a drive that has cut Long Beach water use by 16.5% since fall 2007.

To read today’s Dry Garden column on Long Beach’s raffle for makeovers in the newly redesigned Los Angeles Times online edition, click on I dig it. Wow, I mean, talk about makeovers!

Free the flowers

Posted on | August 12, 2009 | 1 Comment

IF YOU follow gardening in the Los Angeles Times or Los Angeles Magazine or LA Weekly, chances are, you’ve heard of Tara Kolla, recently dubbed Los Angeles Magazine’s “Best Urban Farmer Guru.”

After the jump, Kolla makes her case for a Food and Flowers Freedom Act. If it sounds silly, it might be, but so are some of our zoning ordinances here in Los Angeles.

Kolla is pursuing the act because her urban flower garden, Silver Lake Farms, was nearly run out of business last spring by a litigious neighbor who took exception to the idea that Kolla was growing flowers to sell.

Click here for Tara Kolla’s proposal to update the Los Angeles ordinances to do with urban truck gardening

David Zetland on political influence, insider trading and Cadiz

Posted on | August 12, 2009 | 1 Comment

DAVID ZETLAND, the Berkeley-based water economist and publisher of Aguanomics, today follows up on Cadiz’s June 5 stock surge and the market position of Cadiz CEO Keith Brackpool: Who knew what when in advance of the Cadiz-issued endorsements of the Cadiz groundwater project by Governor Arnold Schwarzenegger, Rep. Jim Costa (D-Fresno) and San Bernardino County Supervisor Brad Mitzelfelt?

“What intrigues me is that Brackpool took options on 60,000 shares on May 22,” Zetland writes. “They were worth about $400,000 then and about $750,000 two weeks later. (He only had 90,000 shares before exercising that option. Was it “in the money”? Did he sell those shares?…)”

“Bottom Line,” Zetland writes, “It’s fine to buy and sell water to make a profit. It’s NOT fine to use political influence to change the value of your water trading company. I would not be surprised if Cadiz has crossed that line.”

To read Zetland’s full posting on recent Cadiz trading, click here.

To read Los Angeles Times writer Michael Hiltzik on the June 5 Cadiz trading, click here.

To read more from Chance of Rain on Cadiz, click on the headline: Cadiz Inc boondoggle is back, The rich are different, Question time for Cadiz, Dear Governor, The Governor’s bump

This post has been updated.

Cap and trading in Sacramento

Posted on | August 11, 2009 | No Comments

THE Los Angeles Department of Water and Power has been worried about the cost of complying with Assembly Bill 32, a 2006 law that requires California to reduce its greenhouse gas emissions by 2020, reports David Zahniser in the Los Angeles Times.

Last month, DWP officials decided to beef up their advocacy efforts in Sacramento by bringing in the author of the global warming bill, Los Angeles Democrat and former Assembly Speaker Fabian Nuñez, to advise the department’s team of lobbyists, writes Zanhiser.

…Department officials have voiced concern that AB 32 would result in a “cap and trade” program that requires utilities that rely on coal power, including the DWP, to purchase expensive pollution credits. That process could result in a “massive transfer of ratepayer money” away from the utility, said DWP spokesman Joe Ramallo.

To be taken to Zahniser’s full story in the Los Angeles Times, click here.

« go back — keep looking »